tradestation international crypto trading with leverage

Pre

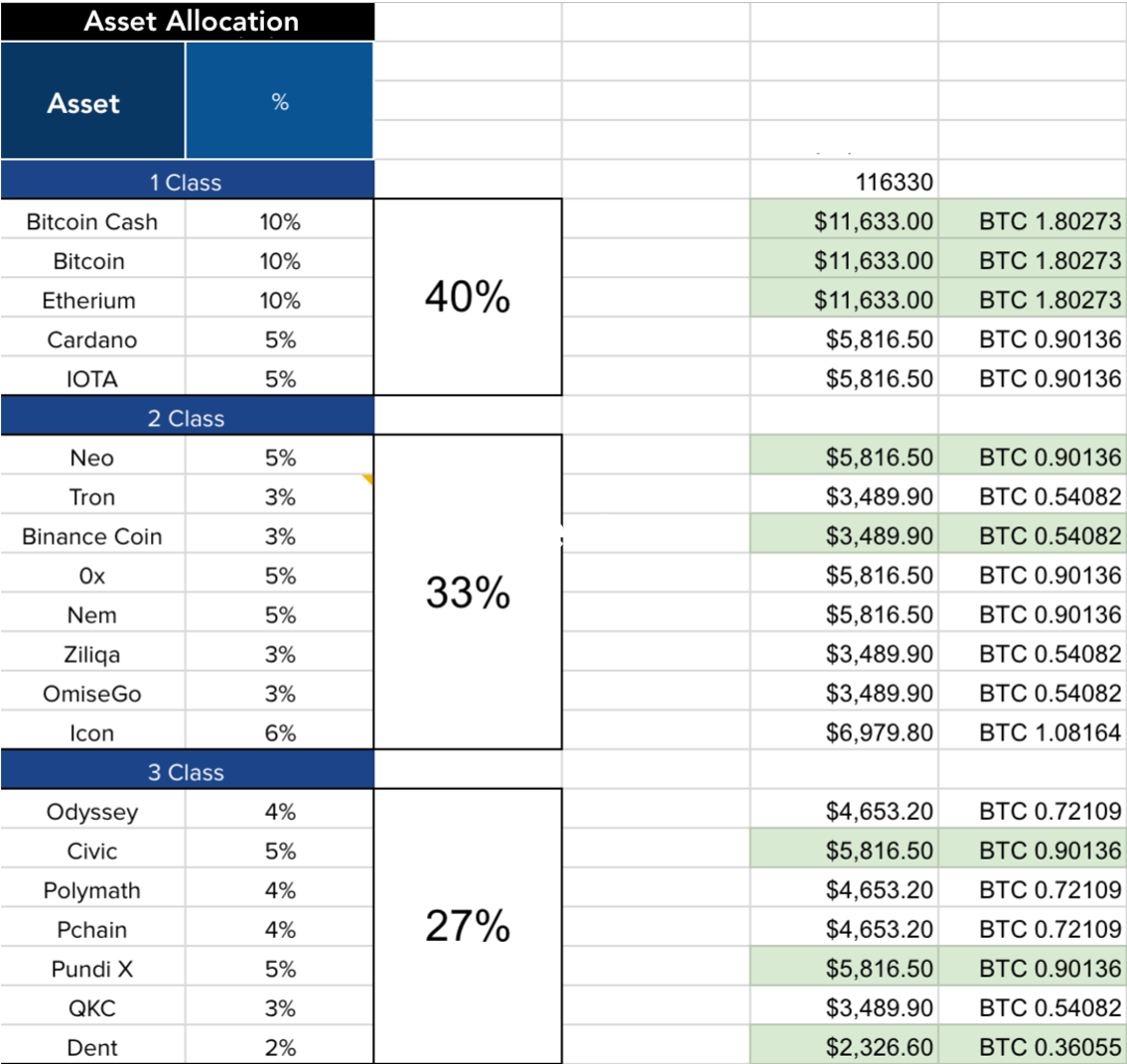

Risk management in Crypto trading 1135 x 1072

TradeStation Global Support FAQs - TradeStation International

TradeStation Securities US/TradeStation Global Contact Get the support you need Looking to Trade the Global Markets? TradeStation Technology + Interactive Brokers Market Reach Trade UK, European, Asia-Pacific and North American Markets Access to Global Equities, Futures, Options and Forex Check Account Comparison Visit TradeStation Global

What is leverage in crypto trading? Leverage (or margin) trading is a more advanced method than just using your deposited capital for buying or selling cryptocurrencies. When trading on leverage, you are borrowing funds from a broker, or in the case of cryptocurrencies, from other traders or the exchange itself.

TradeStation International Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom (registration number 445531). TradeStation International Ltd acts as an introducing broker to TradeStation Group's affiliates and non-affiliates, such as Interactive Brokers (U.K) Limited.

1# Rated 2020 Futures Broker - $0 Commission & Platform Fees

Leverage trading is a tool that allows you to trade with a lower initial investment, multiplying both profits and losses, so there is a high degree of risk involved. Contents Trading Cryptocurrency.

TradeStation Global is a brand of TradeStation International Ltd, which is based in the UK and is regulated by the top-tier Financial Conduct Authority (FCA). TradeStation Global is a combined product offered by Interactive Brokers (IB) and TradeStation for clients outside the EU/EEA. Here are its most important elements:

Crypto leverage trading is a tool for investors to open a long or short position that is much larger than their own capital by leveraging borrowed funds in a transaction. This allows the person to maximise potential profits by increasing their buying power using a small amount of money.

TradeStation Indicators - Trading Indicators

Build a Crypto Portfolio - The Safest Place to Buy Crypto

How to Leverage Trade Cryptocurrency • Benzinga Crypto

Pricing And Trading Fees Commission-Free TradeStation

TradeStation International Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom (registration number 445531). TradeStation International Ltd acts as an introducing broker to TradeStation Group's affiliates and non-affiliates, such as Interactive Brokers (U.K) Limited.

Leverage works through a cryptocurrency exchange or brokerage granting you the right to trade positions that are multiples of your trading capital. You might for example have $1,000 of trading capital. If you executed a regular (non leveraged) trade that realised a 10% gain you would make $100 (1,000*0.10) and end up with $1,100.

The basic of cryptocurrency leverage trading is to allow you to boost your potential profit and also your losses by 5 and 100 times the amount you need to enter a trade. Therefore and for instance, if you want to invest 10,000 dollars in a stock with a leverage ratio of 1:10 and a margin of 10%, you only need to invest 1,000 dollars.

Invest in the Stock Market - Team of Expert Stock Brokers

Crypto Trading with Leverage Trade Crypto Leverage

Videos for Tradestation+international

Stocks Exchange Fees Tradestation Global

Crypto+trading+with+leverage News

TradeStation International Ltd is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom (registration number 445531). TradeStation International Ltd acts as an introducing broker to TradeStation Group's affiliates and non-affiliates, such as Interactive Brokers (U.K) Limited.

Crypto leverage trading All you should know - Nominex Blog

Download Platform TSG - TWS TradeStation Global

What Is Leverage in Crypto Trading? (A Simple Explanation .

International Index Fund - Invest With Green Century

Additional Information on TradeStation Securities International Pricing. Commissions: Available only to non-U.S. residents. $5 per equities trade applies only to the first 10,000 shares per trade — for each order of more than 10,000 shares, a $0.005 per share charge will be assessed on the number of shares in excess of 10,000. Direct-routed equity orders will be charged an additional $0.005 per share.

TradeStation International - Online US and Global Trading .

For investors, leverage in crypto trading is the “firm spot”. With a lever you can lift anything, provided the spot is firm enough. In the market, it is common to “throw a sprat to catch a herring”.

TradeStation Global Review 2022 - Pros and Cons Uncovered

9 Best Crypto Platforms For Leverage Trading (2022 .

What Is Leverage In Crypto Trading BITLEVEX