are coinbase earnings taxable grin blockchain

Coinbase beats earnings estimates as analysts say ...

2388 x 932

Does Coinbase Send A 1099 For Individuals Credit Card ...

2527 x 1253

What To Do With A 1099 from Coinbase or Another Exchange ...

1909 x 1117

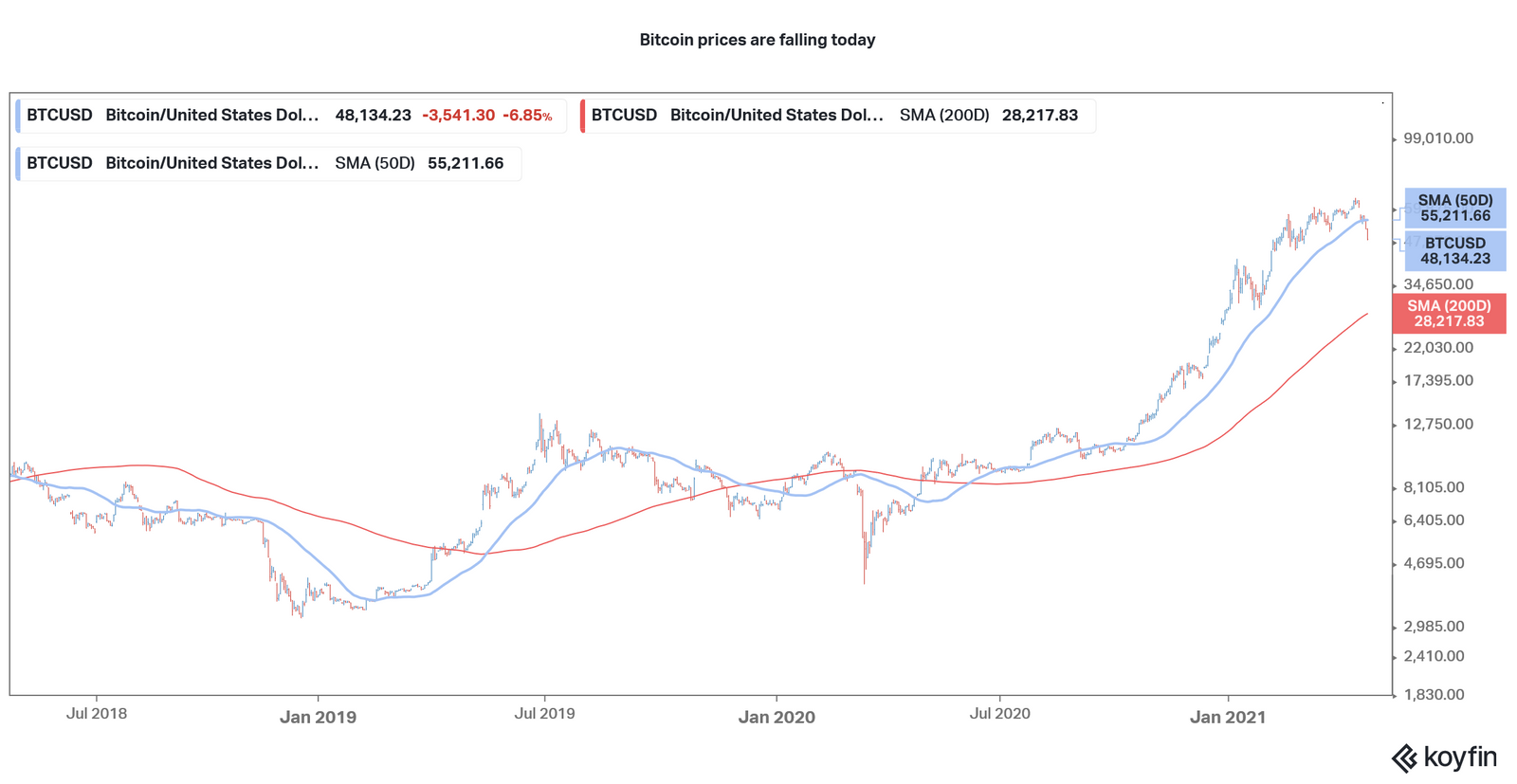

Bitcoin Earnings Tax | How To Get Bitcoin Cash From Coinbase

1200 x 780

Appc Crypto Figure Out Profits From Coinbase Website

1600 x 812

Received Form 1099-K from Coinbase Pro? Here’s how to deal ...

1794 x 1056

Coinbase Revealed Their Stake Entire Crypto - Coinbase ...

2046 x 1088

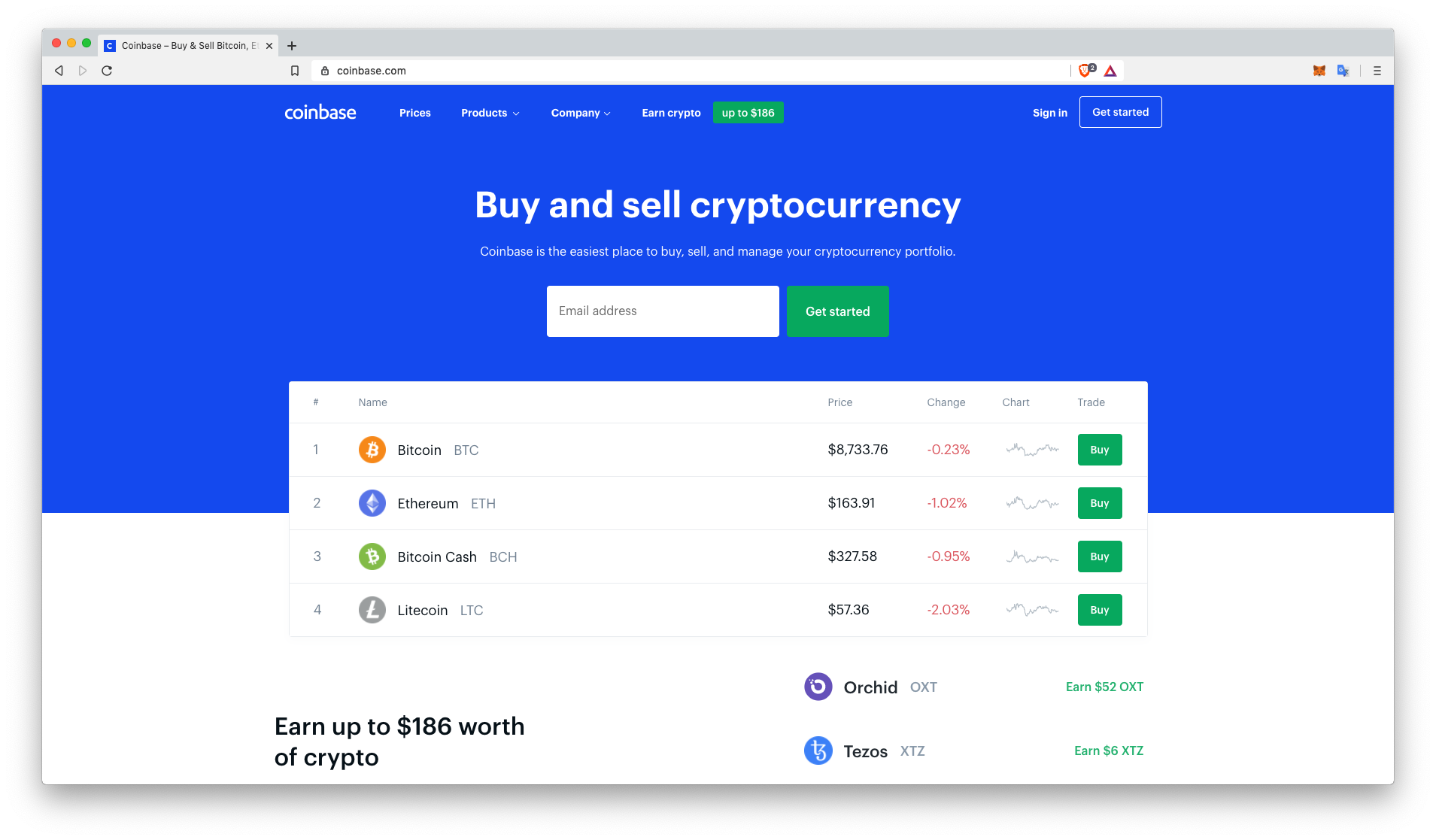

Coinbase Exchange Review - Buy Bitcoin and Ethereum - $10 Free

1329 x 883

Why Is Coinbase (COIN) Stock Falling, and Will It Recover ...

1600 x 827

Coinbase Pro : Coinbase Pro How It Works And How To Use It ...

1522 x 912

Think Or Swim Trading Bitcoin Pairs Btc Hard Fork Coinbase ...

1456 x 1165

Coinbase Download Tax Form - ceriakxsolo

1350 x 1080

How to Download your Coinbase Transactions – Node40

2426 x 1152

Capital Gains Tax Calculator Bitcoin - TAXIRIN

2400 x 1200

Coinbase Shares Increased 3.24%: Why It Happened

1300 x 1171

The IRS is Sending Inaccurate Letters to Thousands of ...

1575 x 1461

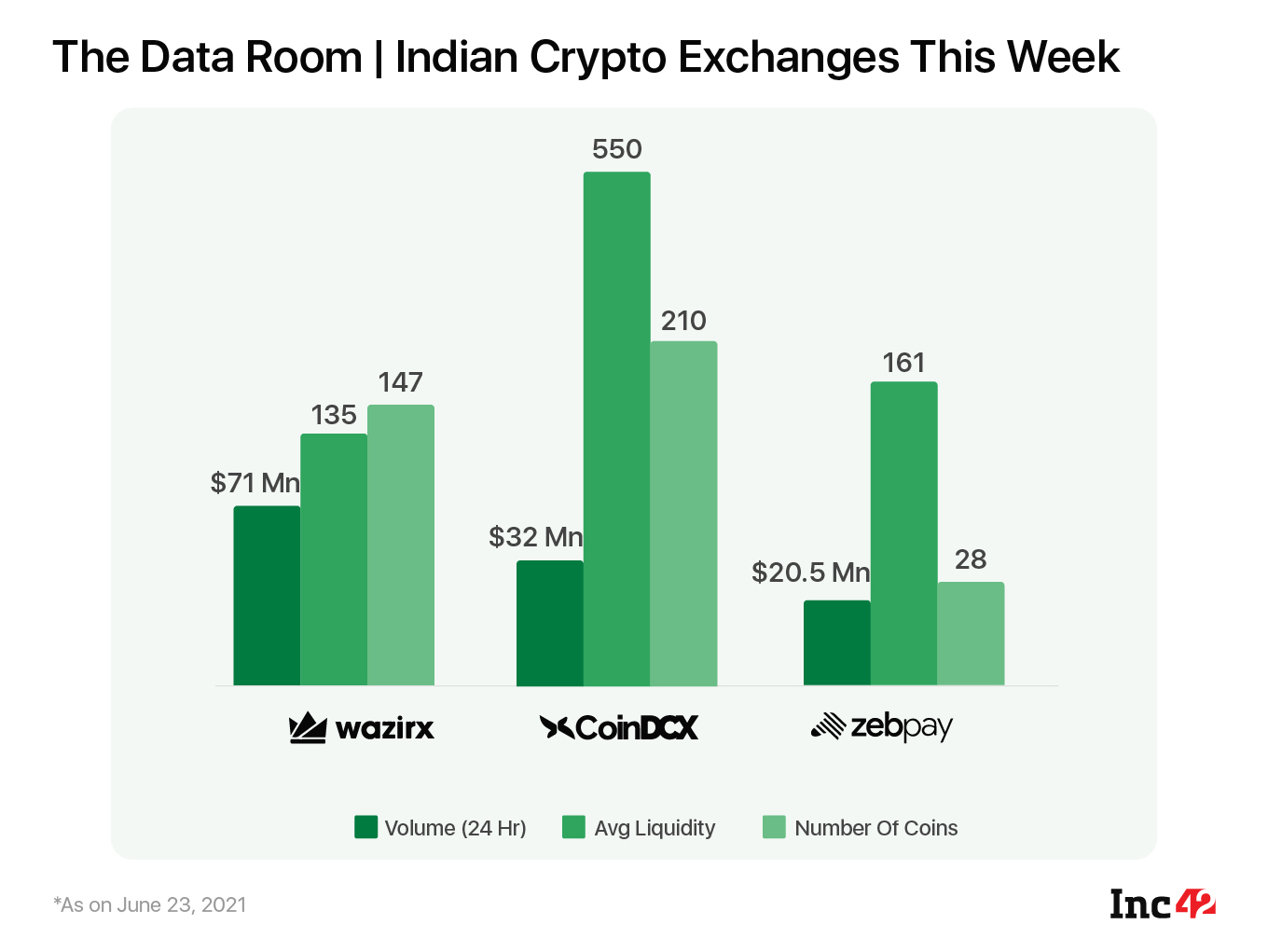

India’s Crypto Economy | The Dark Side Of Crypto Boom

1360 x 1021

Earn Interest On Crypto Coinbase : Coinbase Launches New ...

1680 x 867

Earnings Report Reveals Coinbase Now Head-to-Head With ...

1241 x 853

How To Get Into Bitcoin Reddit | Earn Bitcoin By ...

1502 x 794

Coinbase to Hand Over 2019/20 Customer Data to HMRC

1300 x 890

Coinbase: 5 Things You Need To Know About This ...

2000 x 1333

Coinbase Plans To Go Public Evading the Traditional IPO ...

1422 x 900

PRESS RELEASE: Coinbase Adds Zcash to Retail Crypto ...

1500 x 1000

American Tax Office (IRS) Goes After American ...

1250 x 835

Deutsche Boerse Won’t De-List Coinbase Shares After Data ...

1500 x 1000

Coinbase: tax chief Zlatkin criticizes new crypto bill ...

2560 x 1707

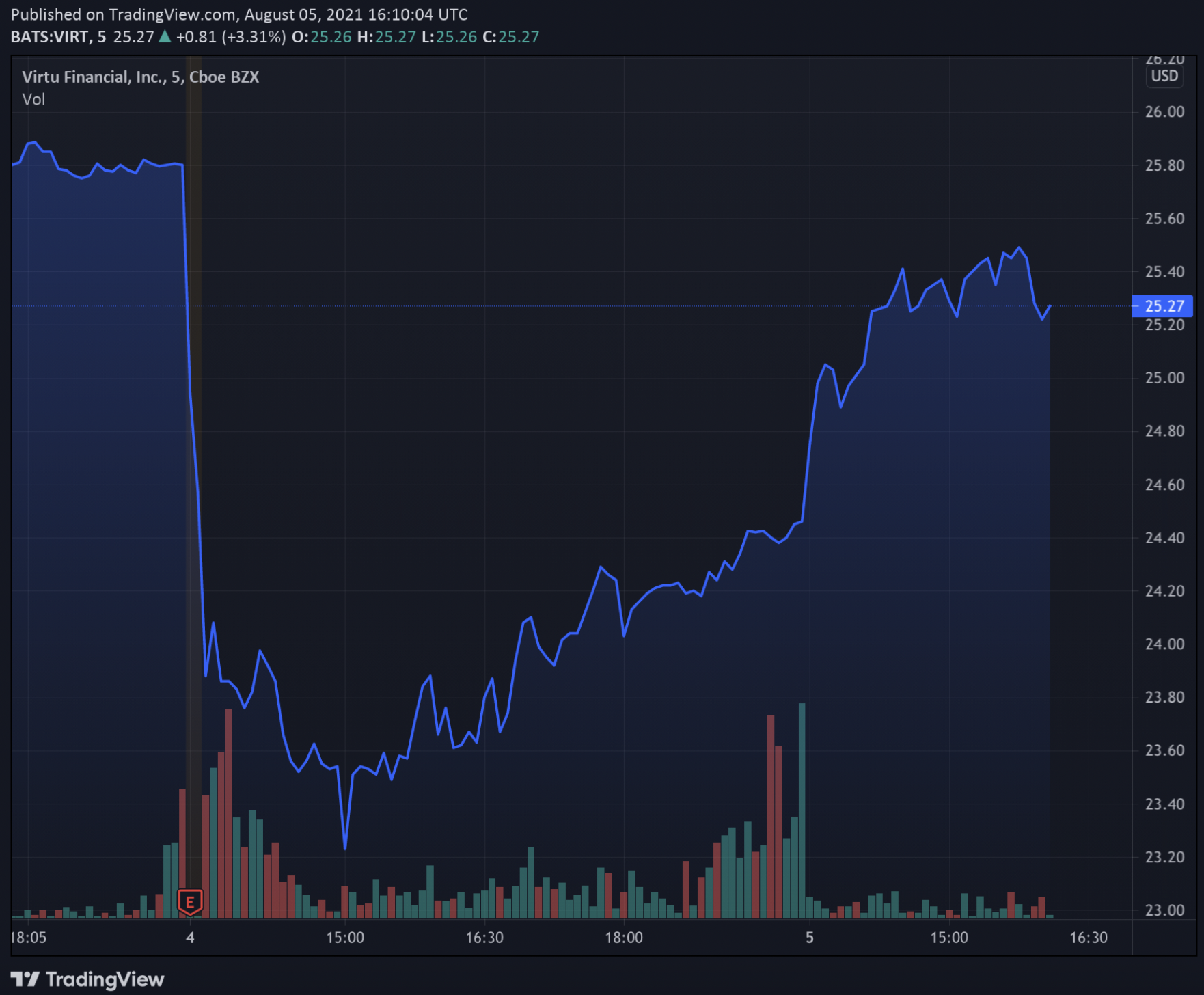

Market making giant Virtu Financial is now active on ...

1762 x 1456

John Doe Summons Coinbase Who Is Buying Ethereum – One ...

1200 x 800

How To Get Refund On Bitcoin - How Do I Earn Free Bitcoin

1200 x 850

:max_bytes(150000):strip_icc()/GettyImages-959997240-593e261ff24a4908a94ac280c33dfbe1.jpg)

Coinbase Issues 1099s: Reminds Users to Pay Taxes on ...

1500 x 1000

Warning: Bitcoin Profits Are Considered Taxable Income by ...

1152 x 768

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5fbd54503ebb4e61f224e2db%2F0x0.jpg)

Bitcoin Tax Coinbase : Tax Implication Of Converting ...

1200 x 800

Income Tax, ITR Filing on Cryptocurrency Earnings: Bitcoin ...

1200 x 800

Coinbase will Invest 10% of its Quarterly Net Income in ...

1160 x 870

RON ENGLISH TO BRING POPAGANDA TO BLOCKCHAIN AND AUGMENTED ...

1080 x 1440

Hyperledger On Verge of Merging Blockchain IBM, Digital ...

1500 x 1000

Bitcoin CEO: MicroStrategy's Michael Saylor Explains His ...

2164 x 1542

Overstock Is Set to Finally Pay Out Its Digital Security ...

1420 x 916

Blockchain and the Race Towards Irrelevance - CoinDesk

1500 x 1000

London Metal Exchange Backs Plan to Track Physical Metals ...

1500 x 906

French President Says Blockchain Could Put Europe at ...

1500 x 916

Overstock's Medici Land Governance Inks Deal for Local ...

1500 x 805

Payment Provider Fleetcor to Pilot Ripple's XRP ...

1500 x 1000

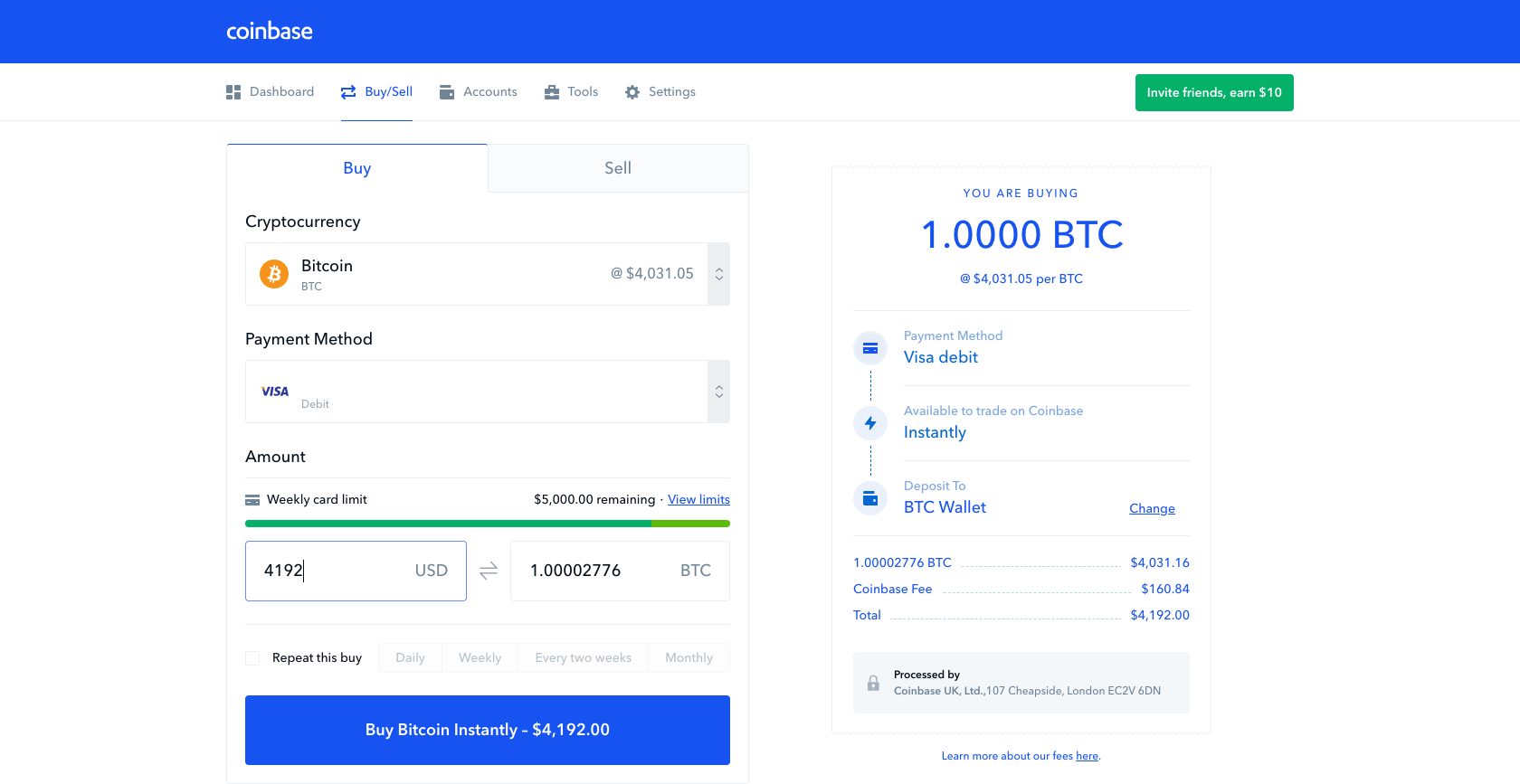

3 Steps to Calculate Coinbase Taxes (2022 Updated)I am starting to do my taxes and I am not sure if the coins I got form Coinbase earn is a income or gift. Press J to jump to the feed. Press question mark to learn the rest of the keyboard shortcuts Grin Mining: A Beginners Guide on How To Mine GrinGrinDoes Coinbase Report to the IRS? CryptoTrader.TaxCoinbase Tax Documents to File Your Coinbase Taxes ZenLedgerWhat Is Grin? The First Major Blockchain to Implement .In essence, Grin is a cryptocurrency that uses a light blockchain and which operates privately – qualities that put Grin in the news throughout 2020. So, what is Grin? The developers of Grin wants to make transacting online easy for everyone, without any risk of censorship or any restrictions whatsoever. Understanding crypto taxes CoinbaseGrin is a private, lightweight, MimbleWimble blockchain project. Like Monero and Zcash, the goal of Grin is to keep your identity and financial history private as you participate in the network. Although Tom Elvis Jedusor first proposed MimbleWimble in 2016, the idea has only recently gained traction. You may receive a 1099-MISC if: You are a Coinbase customer AND. You are a US person for tax purposes AND. You have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking in 2020. The Grin blockchain has no addresses and doesn’t store data about the amounts transferred. On the Grin network, a new block is generated every 60 seconds, and each has a grin mining reward of 60 grins. The network is set to generate 1 grin per second forever. This creates an increase in supply and a decrease in the inflation rate. GrinPreparing your gains/losses for your 2021 taxes Coinbase HelpWhile rewards and fees from Earn, Staking or lending are taxable, they are reported separately from gains and losses. If you made these types of transactions (totalling $600 or more) in 2021, you will receive a 1099-MISC form from us that you can use to report this income, separate from gains and losses. GRIN - A Multi Criteria Evaluation of Blockchain Technologies .At the same time, Grin blockchain should be allowed to scale in parallel with the number of its users rather than with the number of transactions. Only accessibility, openness and decentralization will make the blockchain technology genuinely future proof. Grin wants to take the decentralization concept to a level going beyond mere technicalities. GRIN - Blockchain Technology Enabled E-Voting System .Mining Grin - your complete guideGrin price today, chart, market cap & news CoinGeckoBlockchain Technology Enabled E-Voting System. Challenges, Impacts and Developments - Informatik / IT-Security - Seminararbeit 2020 - ebook 12,99 € - GRIN Grin coin is a private & lightweight open source project based on the mimblewimble blockchain implementation. MimbleWimble is a lightweight blockchain protocol proposed by anonymous author that goes by the name Tom Elvis Jedusor (inspired by Harry Potter) in July 2016. Solved: Should i include "coinbase earn" crypto currencies.GRiN — THE MIMBLEWIMBLE BLOCKCHAIN Grin is a privacy-preserving digital currency built openly by developers distributed all over the world. Grin has no amounts and no addresses. Transactions can be trivially aggregated. To hide the origin of a newly created transaction, it gets relayed among a sub-set of peers before it is widely broadcasted. A Multi Criteria Evaluation of Blockchain Technologies Applied to the Healthcare System - Computer Science - Master's Thesis 2019 - ebook 34.99 € - GRIN It says "reporting rewards." Although also, I'm not sure if the tax bit at the end is referring to earning $600 in income taxes, though, or $600 strictly from crypto rewards. Because that would be relevant for me. So it sounds to me that Coinbase Earn could be an exception to capital gains, based instead as taxable income upon receipt. Coinbase Tax Resource Center Coinbase HelpA Beginner's Guide to Grin Cryptocurrency GRIN Coin ReviewCoinbase earnings are taxable only when you transfer, sell, exchange or do something with it. Coinbase earns just sitting idly in your wallet is not taxable. ZenLedger easily calculates your crypto taxes and also finds opportunities for you to save money and trade smarter. Unlike the vast majority of blockchain projects, Grin's development is not motivated by profit for either its developers or early adopters. As a measure of this, the community has ensured that: Grin's launch was pre-announced, open, and fair↗. There were no pre-mining or any other funny business. Earning other income: You might earn a return by holding certain cryptocurrencies. This is considered taxable income. Although this is sometimes referred to as interest, the IRS treats it differently than interest you'd earn from a bank. Received $600 or more in cryptocurrency from Coinbase Earn, USDC Rewards, and/or Staking Are subject to US taxes If you meet each of these three criteria, both you and the IRS will be sent a copy of your 1099-MISC. 1099-MISC details the amount of income you have earned from Coinbase. This income needs to be reported on your taxes. Is Coinbase earn taxable? : CoinBaseIf you are subject to US taxes and have earned more than $600 on your Coinbase account during the last tax year, Coinbase will send you the IRS Form 1099-MISC. What a 1099 from Coinbase looks like. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase, but you can still generate reports on the platform and then use these for your crypto tax software or to help your financial advisor.