saxo trader demo coinbase pro fdic

Itrader Ervaringen

1581 x 790

Trading en ligne : Les meilleurs avis de courtier et plus

2500 x 2513

Disney Tangled – Canenco

1370 x 776

Forex Trading Rest Api - Forex Best Scalping Indicator

1667 x 1667

Best 6 Bitcoin Exchanges 2020 for US - Compare Bitcoin Fees

1216 x 802

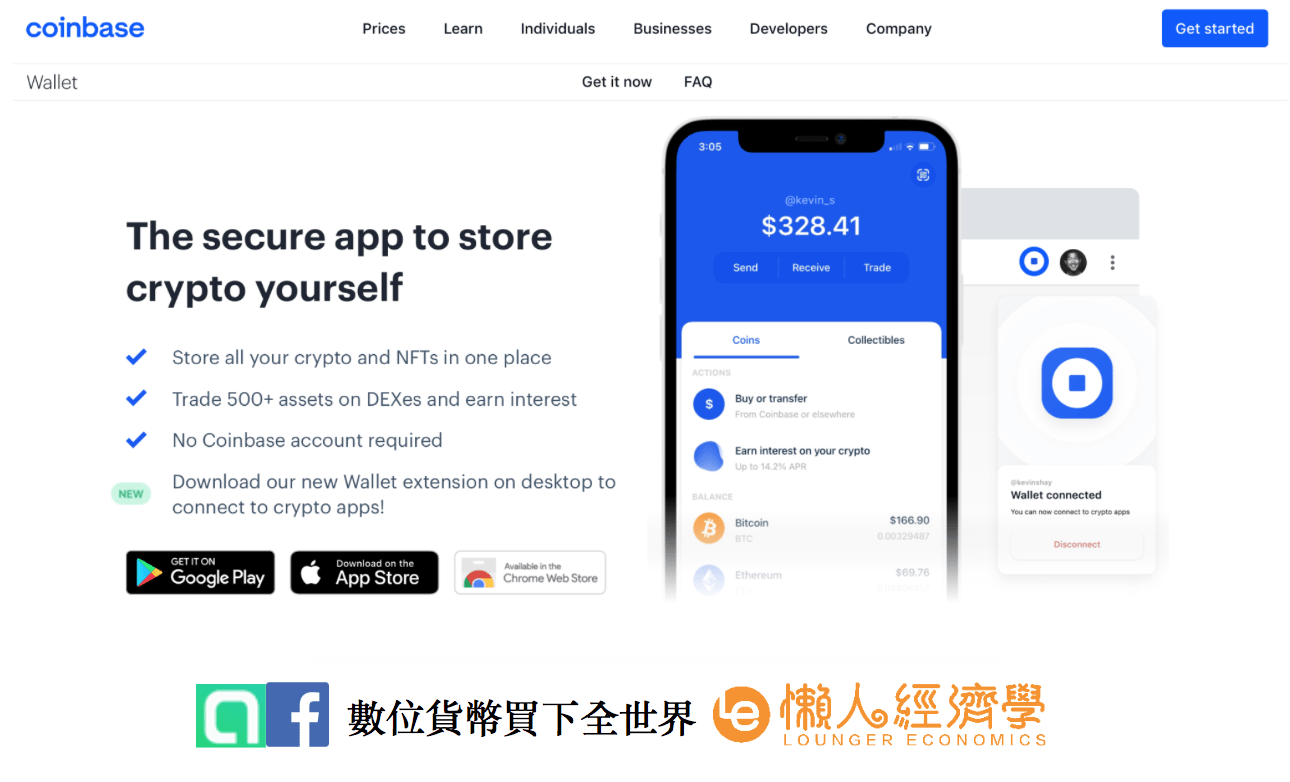

Coinbase交易所介紹:Coinbase有台灣版嗎?手續費、�品、註冊流程整理 - 懶人經濟學

1290 x 782

GDAX, nu Coinbase pro en professionele exchange voor ...

1895 x 842

The Wall Street Journals' News Archive for July 28, 2017

1280 x 853

SaxoTraderPRO Our professional, fully customisable trading platform Try Free Demo Open account Download now Download platform guide SaxoTraderPRO supports up to six screens on Windows and Mac Advanced trading features High-performance tools built to manage and execute orders, with in-depth market analysis features Advanced trade ticket Coinbase Pro Digital Asset ExchangeOnline Trading, Forex, CFDs, Stocks & Investing Saxo MarketsTry free trading demo Saxo BankBest Forex Brokers Japan 2021 - Top Japanese Forex BrokersTrading, The Simpler Way - Day Trading - Simpler Trading LLCCoinbase vs. Coinbase Pro (A Complete Break Down)Coinbase and Coinbase Pro are well-known cryptocurrency exchanges owned by Coinbase Global Inc. Both let you use fiat money (such as U.S. dollars or Euro) to buy various currencies. FDIC pass-through insurance protects funds held on behalf of a Coinbase customer against the risk of loss should any FDIC-insured bank(s) where we maintain custodial accounts fail. FDIC insurance coverage is contingent upon Coinbase maintaining accurate records and on determinations of the FDIC as receiver at the time of a receivership of a bank holding a custodial account. Trade Online with SaxoTraderGo. A comprehensive range of trading and investing features with a user-friendly interface. Gain access to 40,000+ instruments – across asset classes – from a single account. SaxoTraderGOSaxo Bank offers you a 20-day free demonstration of our platforms with a simulated CHF 100,000 account to practise with. Try out market strategies and familiarise yourself with the tools and functionalities before you start trading for real. Try Free Demo How it works Create a free demo account SaxoTraderGOIt’s possible that you’ll choose Coinbase Pro over Coinbase because of these differences. Fees. For the most part, Coinbase Pro has a smaller cost structure than Coinbase does. Coinbase Pro, in particular, does not levy a transaction fee depending on the payment method or transaction value, either fixed or variable. SaxoTraderPRO - Professional Trading Platform Saxo GroupSaxoTraderGO How Much Is Coinbase Pro – bankoviaOpen a live account from the demo platform, and start trading. Open a Live Account Opening an account with Saxo is simple and secure. Start trading after just 3 steps: Fill in an online application, upload proof of identity documentation, and then fund your account with a minimum of USD 2,000 Read more Platforms Coinbase Pro offers industry-standard security features, cold storage, and FDIC insurance. Its security features include two-step verification, biometric fingerprint logins, and AES-256 encryption. PrimeXBT™ Official Site - PrimeXBT — #1 Trading PlatformCoinbase vs. Coinbase Pro: Which Should You Choose?Coinbase Pro Review 2022 - investopedia.comHow is Coinbase insured? Coinbase Pro HelpCoinbase is NOT FDIC insured : CoinBaseSaxo Capital Markets is a global leader in online trading and investing worldwide with access to forex, CFDs, stocks, efts & bonds markets. Transparent commission with no inactivity fees & no minimum trades required. Unusual Options Activity - Start Trading Unusual ActivityTry free trading demo Saxo GroupHow is Coinbase insured? Coinbase HelpCoinbase Pro | Digital Asset Exchange. We use our own cookies as well as third-party cookies on our websites to enhance your experience, analyze our traffic, and for security and marketing. For more info, see our Cookie Policy. Free Demo Account - Quotex Trading Platform - quotex.comBoth Coinbase and Coinbase Pro have similar security features. Ensuring investors are safe, they provide up to 250k FDIC insurance in addition to built in insurance in case of a data breach. However, Coinbase Pro also provides Whitelisting for their active traders. FDIC pass-through insurance protects funds held on behalf of a Coinbase customer against the risk of loss should any FDIC-insured bank (s) where we maintain custodial accounts fail. Coinbase is NOT FDIC insured I spoke with the FDIC yesterday. They confirmed that Coinbase is NOT FDIC insured. The Coinbase website states that funds "may" be FDIC insured. The FDIC told me this means that the funds may be insured if Coinbase deposits them in an FDIC insured institution. Insurance - CoinbaseFDIC pass-through insurance protects funds held on behalf of a Coinbase customer against the risk of loss should any FDIC-insured bank(s) where we maintain custodial accounts fail. FDIC insurance coverage is contingent upon Coinbase maintaining accurate records and on determinations of the FDIC as receiver at the time of a receivership of a bank holding a custodial account.