simplex crypto coinbase taxes faq

Simplex Partners With Bybit, the World’s Fastest-Growing ...

1536 x 864

Simplex Debuts Fiat On-Ramp for Blockchain Game Townstar

1400 x 933

Buy Crypto with credit card on Binance - Crypto Tutorials

1322 x 1534

Raising The Gold Standard: Celsius Now Offers Purchase Of ...

1920 x 768

How can I use my Credit/Debit Card to purchase Crypto ...

1440 x 814

Binance Adds 15 Fiat Currency Options for Purchasing Crypto

1434 x 955

Exchange KuCoin Enables Credit Card Purchases of Crypto

1434 x 955

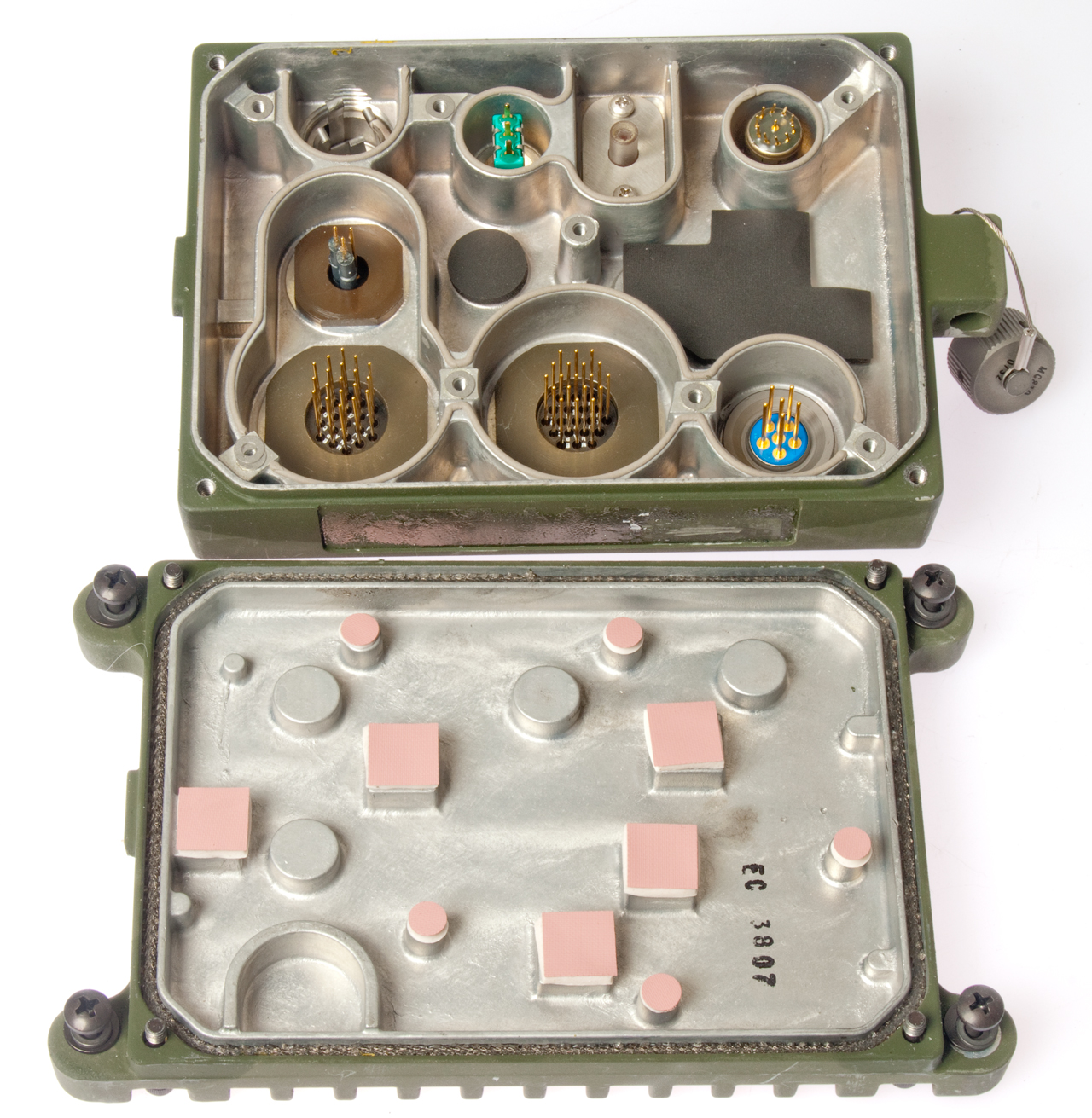

Crypto Machines

1280 x 1311

Press Releases – Blokt – Privacy, Tech, Bitcoin ...

1068 x 801

Blog — Page 3 of 7

1600 x 900

Read, watch, listen - Numerai Tournament

2541 x 1143

Cryptocurrency Tax Reporting, Clarified: What To Include ...

1500 x 950

Coinbase Help Center; Taxes, reports and financial services ; USD Coin rewards FAQ; USD Coin rewards FAQ. USDC IS NOT LEGAL TENDER. USDC IS A DIGITAL CURRENCY AND COINBASE HAS NO RIGHT TO USE ANY USDC YOU HOLD ON COINBASE. COINBASE IS NOT A DEPOSITORY INSTITUTION, AND YOUR USDC WALLET IS NOT A DEPOSIT ACCOUNT. TL;DR: Simplex is a unique combination of a cryptocurrency brokerage platform and a payment gateway solution to some of the biggest crypto exchanges. While still being relatively unknown, Simplex provide you - the user - with a worry-free way of purchasing your desired cryptocurrencies at some reasonable prices. If you are subject to US taxes and have earned more than $600 on your Coinbase account during the last tax year, Coinbase will send you the IRS Form 1099-MISC. What a 1099 from Coinbase looks like. If you are a non-US Coinbase customer you will not be sent any tax forms by Coinbase, but you can still generate reports on the platform and then use these for your crypto tax software or to help your financial advisor. FAQ - CoinbaseBuild a Crypto Portfolio - #1 in Security Gemini CryptoOnce payment is completed, you can check your payment status on Simplex. The crypto amount quoted is based on the current rate and is not final. If the rate changes by more than +/-2.5% you will be asked to reconfirm the transaction via email from Simplex. Cryptocurrency transactions are irreversible. Coinbase Help Center; Taxes, reports and financial services ; Understanding Coinbase taxes; Understanding Coinbase taxes. For the 2021 tax season, US customers can use Coinbase Taxes to find everything needed to file Coinbase.com taxes. Coinbase Taxes will help you understand what Coinbase.com activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports (including IRS forms) you need to file. Buy Crypto with Credit Card CoinomiCoinbase Tax Resource Center For the 2020 US tax season, Coinbase will issue the IRS Form 1099-MISC for rewards and/or fees through Coinbase.com, Coinbase Pro, and Coinbase Prime. Non-US customers will not receive any forms from Coinbase and must utilize their transaction history to fulfil their local tax obligations. Simplex Simplex BankingAt Coinbase, we see crypto as the foundation for tomorrow’s open financial system — but it’s also a part of today’s traditional one. To answer the many questions on crypto and taxes, the IRS has issued crypto tax guidance. In previous tax seasons, we received a lot of questions from crypto newbies and experienced customers alike. USD Coin rewards FAQ Coinbase HelpCoinbase vs Simplex cryptocurrency exchange overall score comparison reveals that Coinbase has a higher overall score of 9.6, while Simplex gathered an overall score of 7.7. If we look at the ease of use, it’s clear that in this Coinbase vs Simplex comparison, Coinbase has better & smoother user experience than Simplex. Coinbase Wallet is a software product that gives you access to a wide spectrum of decentralized innovation - buy and store ERC-20 tokens, participate in airdrops and ICOs, collect rare digital art and other collectibles, browse decentralized apps (DApps), shop at stores that accept cryptocurrency, and send crypto to anyone around the world. Simplex, a licensed financial institution, empowers its vast network of partners to accept the widest range of payment methods, including Visa, MasterCard, Apple Pay, SWIFT, SEPA, and more! Zero risk, zero rolling reserve, zero security incidents Highest conversion rates, multiple acquiring . Gate.io Choose Simplex to Buy Crypto and Win In a $5,000 .Coinbase vs Simplex: Features, Fees & More (2022)3 Steps to Calculate Coinbase Taxes (2022 Updated)Do you agree with Simplex's 4-star rating? Check out what 11,373 people have written so far, and share your own experience. Coinbase Wallet FAQSimplex Simplex is the fiat/crypto pioneerCoinbase is also registered as a Money Services Business with FinCEN. Coinbase is required to comply with a number of financial services and consumer protection laws, including: The Bank Secrecy Act, which requires Coinbase to verify customer identities, maintain records of currency transactions for up to 5 years, and report certain transactions. ‘Gate.io Fiat Gateway Marathon | Choose Simplex to Buy Crypto and Win In a $5,000 Prize Pool!’campaign was a huge success, thank you all for participating! Rewards have been distributed to all winners. View the reward you received at “My Wallets”–“ My Billing Details”. For details and rules of the a. Simplex Reviews Read Customer Service Reviews of simplex.com2020 tax guide: crypto and Bitcoin in the U.S. CoinbaseUnbiased Simplex Review 2022 - Is Simplex Legit & Safe?Understanding Coinbase taxes Coinbase HelpCoinbase reports some of your transaction activity to the IRS if you meet certain criteria. Coinbase will send both you and the IRS a copy of a 1099-MISC if: - You are a Coinbase customer AND - You are a US person for tax purposes AND - You have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking in 2020. Understanding crypto taxes CoinbaseGive your customers the power of a bank card As a Principal Member of the Visa network, Simplex gives each partner the competitive advantage of offering a crypto friendly debit card. Want to offer one to your customers? Let’s talk Built for you: complex banking made Simplex Partners Individuals Choose the Simplex payments you want to enable Coinbase Tax Resource Center Coinbase Pro HelpHow to do your Coinbase Taxes CryptoTrader.TaxCoinbase Gain/Loss Report. This tax season, Coinbase customers will be able to generate a Gain/Loss Report that details capital gains or losses using a HIFO (highest in, first out) cost basis specification strategy. This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year, using our . Simplex+crypto - Image Results