what does coinbase report to irs no fee crypto trading platform

Coinbase Is a Popular Investment Platform, but Is It Safe?

2160 x 1131

Price Action Breakdown Pdf Download Define Binary Trading ...

1527 x 1122

Credit Card Rewards: Avoiding Eye Contact with the IRS ...

1378 x 1378

Crypto startup Change offers customers no-fee trading app

1530 x 1020

Blockchain network fees

1424 x 800

Phemex Adds Zero Fee Spot Trading, Challenges Exchange Giants

1518 x 855

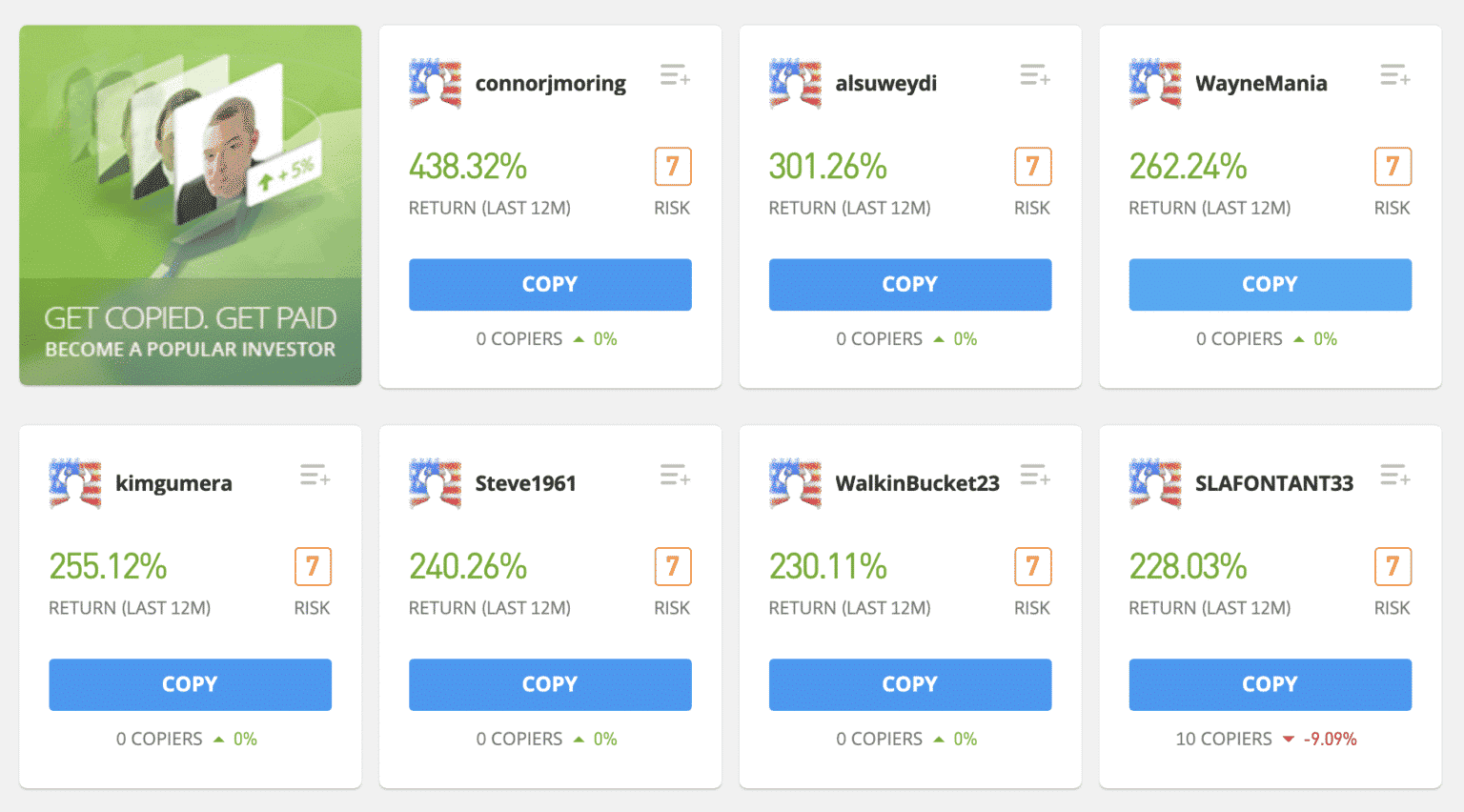

7 Best Crypto Trading Bots for Money, Happiness & Love!

1536 x 852

Trading app Robinhood adds two new cryptocurrencies ...

1910 x 1000

Cryptocom Fees Vs Coinbase / Investing In Cryptocurrency ...

1148 x 1200

SmartFi - The Open Finance Platform | Crypto Exchange

1600 x 1484

Bitbank – Reviews, Trading Fees & Cryptos (2021 ...

1915 x 939

Bitvavo - YourCryptoLibrary

2048 x 927

There are no deposit or withdrawal charges above the standard network fees for your chosen cryptocurrency. The trading fees are 0.025% for makers and 0.075% for takers, so although it’s not fee-fee trading, it’s pretty close to it. However, if you sign-up for Phemex premium account, you get a literal zero-fee trading status. What exactly does CoinBase report to the IRS? - QuoraYes, you'll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not, Coinbase does report your crypto activity to the IRS if you meet certain criteria (you should be a Coinbase customer; a US person for tax purposes; should have earned $600 or more in rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking). What To Do With Your Coinbase Tax Documents? Let’s Find Out!Does Coinbase report to the IRS? Yes. Coinbase reports your cryptocurrency transactions to the IRS before the start of tax filing season. As a Coinbase.com customer, you'll receive a 1099 form if you pay US taxes and earn crypto gains over $600. Yes. Crypto exchange Coinbase began submitting 1099 forms to the IRS and to individuals users in 2017. Here is a list of the best crypto exchanges for spot/margin trading with zero-fees. Phemex. Phemex is a quite fresh global cryptocurrency derivatives exchange offering Bitcoin, Ethereum, XRP, Litecoin, and EOS perpetual contracts, with up to 100x leverage. Phemex also provides couple of different monthly plans that have different fee structures, with premium paying customers for example paying zero spot trading fees. Does Coinbase Report to the IRS? ZenLedgerIn Conclusion. Yes, Coinbase does report your crypto activity to the IRS if you meet certain criteria. It’s very important to note that even if you do not receive a 1099, you are still required to report all of your cryptocurrency income on your taxes. Not doing so would be considered tax fraud in the eyes of the IRS. The best way to buy Bitcoin free of trading fees is to use a cryptocurrency platform that offers zero-fees and commissions in addition to the spot market price. Exchanges such as Shapeshift, Kucoin and Phemex allow users to deposit crypto currency and stablecoins which can be instantly exchanged without fees or spread charges. 5 Crypto Exchanges With The Lowest Fees CryptoladBest Crypto Exchanges With Low Or No Trading Fees in 2022Does Coinbase Report to the IRS? CryptoTrader.TaxThe Best Free Crypto Trading Platforms for 2021Coinbase Tax Documents to File Your Coinbase Taxes ZenLedgerDoes Coinbase Report to the IRS? TokenTax7 Best Exchanges To Trade Crypto With Zero Fees hedgewithcryptoIn short, here in July 2021, trading crypto without fees generally means either using a platform like Robinhood where selection and functionality are limited or meeting extra requirements like with FTX’s 25 FTT requirement. Meanwhile, trading for low fees means picking an exchange like Binance and then taking part in the discounts. Best Free Trading Platform with No Fees - Cheapest Brokers .Does Coinbase Report the IRS KoinlyNow in the coming year (2021), Coinbase will not issue Form 1099-K. They will only be reporting 1099-MISC for those who received $600 or more in cryptocurrency from Coinbase Earn, USDC Rewards, and/or Staking in 2020. You can learn more about how Coinbase reports to the IRS here. Shapeshift, established in 2014, is a digital marketplace providing crypto services to users globally. They offer a free crypto trading platform to swap crypto assets in a quick, safe, and secure environment. Shapeshift has a new platform to buy Bitcoin with no fees in order to compete with other cryptocurrency exchanges. Coinbase to Stop Reporting Form 1099-K to IRS and Customers .Many platforms don't have security as their top priority but are offering no transaction fees. These platforms are vulnerable to cyberattacks, and a lot of your important data can be compromised. If you want to find a good cryptocurrency platform with cheap transaction fees, you should always keep these important factors in mind. Does Coinbase report to the IRS? Yes. Currently, Coinbase sends Forms 1099-MISC to users who: Are U.S. traders. Made more than $600 from crypto rewards or staking in the last tax year. The exchange sends two copies of the form: One to the taxpayer and one to the IRS. If you're looking to invest in digital currencies like Bitcoin or XRP - the best free cryptocurrency trading platform is eToro. Not only does this free cryptocurrency trading platform allow you to invest commission-free - but the minimum stake is just $25. How to Trade Cryptocurrency Without Paying FeesIt’s incredibly important to track and report all cryptocurrency transactions to avoid a crackdown from cryptocurrency platforms and the IRS. The Big Question: Does Coinbase Report to the IRS? The answer? Yes. Coinbase, the top cryptocurrency exchange in the United States, began submitting 1099 forms to the IRS and individual users in 2017. Though the company stands out as one of the safest and most secure platforms for cryptocurrency selling and trading, it has butted heads with the IRS . Let's go over some of the basics here. First, you need to know about the form 1099-K. This is an IRS form that Coinbases uses to report financial transactions - like a W-2 from an employer, or a 1099-INT for bank interest. The only difference? It states that you received money (not necessarily income). It's to alert the IRS to look a 9 Best Zero-Fee Cryptocurrency Trading Exchanges in 2021Coinbase On Reporting To The IRS As with any other cryptocurrency present in the market space, Coinbase reports to the IRS via sending out the 1099-MISC form. The form here is sent out in two copies, one that goes to the eligible user who has more than $600 obtained from the crypto stalking or rewards, while the other is sent to the IRS directly.