most reliable crypto exchanges turbotax coinbase pro

Wisenex review: Most reliable and user-friendly ...

1397 x 786

Launch Cryptocurrency Exchange Like Binance in 7 Days ...

1920 x 1080

Top crypto exchanges of 2020 infographics - Awesome graphic

2550 x 8838

Coin Info Exchange - Cryptocurrency Details Provider in ...

2560 x 1440

(Review) Best Cryptocurrency Exchange (Reliable Bitcoin ...

1920 x 1271

???? What is GerFin? | Best crypto, Crypto coin, Cryptocurrency

1080 x 1080

List crypto exchanges

2302 x 1306

How To Stay Safe On Crypto Exchanges? - How To Buy Bitcoin ...

1472 x 828

Cryptocurrency Exchanges - 7 Biggest Cryptocurrency ...

2121 x 1414

Us Based Crypto Exchanges With Most Coins : Trade Crypto ...

1300 x 954

Best Cryptocurrencies for Day Trading | Day trading ...

1200 x 900

Do crypto exchanges make good money | executium Trading System

1200 x 900

How Reliable Is Vertex Market �ryptocurrency Exchange? - 4 ...

1920 x 1080

Bittrex Us Customers : Bittrex Review 2021 And Beginner S ...

4000 x 2250

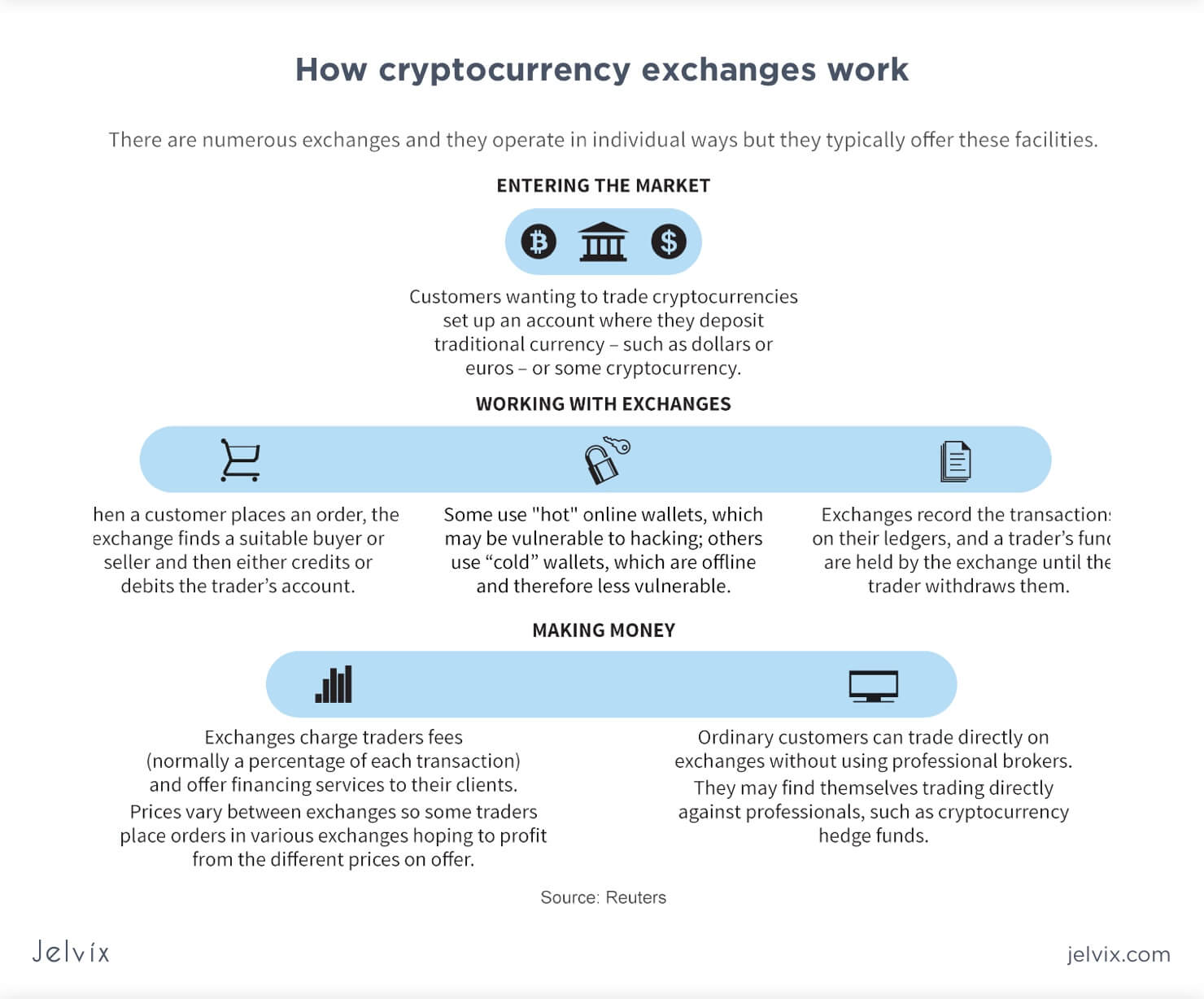

How to Create a Cryptocurrency Exchange Platfrom | Jelvix

1480 x 1228

What Exactly is a Centralized Crypto Exchange | XCritical

1598 x 1000

Bitcoin for Beginners: Which Cryptocurrency Exchange ...

1392 x 1392

Wisenex review: Most reliable and user-friendly ...

1785 x 789

BuniSwap - A trusted and secure bitcoin and crypto exchange

1056 x 798

Consulting24 has launched BuyBitcoin24 domain to compare ...

1542 x 988

TTNEX is The Final Solution For CryptoCurrency Exchange ...

1200 x 1004

Top Crypto Exchanges By Volume Top 10 Best Crypto ...

1920 x 1080

CryptoCurrency Services | Exchange | Light47X

1170 x 780

1 Inch Crypto Exchange : binance-crypto-exchange-1 ...

1100 x 918

Best Crypto Exchanges in 2021 | CryptoTrader.Tax

4583 x 2208

Best Crypto Exchanges in 2021 | CryptoTrader.Tax

4583 x 2208

This Respected Crypto Analyst is Betting on an Imminent ...

2560 x 1545

What’s the Difference between Margin and Leveraged Crypto ...

2560 x 1545

5 Cryptocurrency Exchanges to Help You Buy Bitcoin

1536 x 806

CryptoCurrency Services | Exchange | Light47X

1170 x 780

Top Crypto Exchanges By Volume Looking For The Top Crypto ...

1600 x 833

Should You Be Investing In Bitcoin in 2020? - Crypto Current

2048 x 1226

Half of crypto exchanges have security problems - CryptoMart

1920 x 1080

Us Based Crypto Exchanges With Most Coins : Trade Crypto ...

1450 x 966

Crypto Exchanges By Volume This Exchange Has Quickly Grown ...

1920 x 1807

Coinbase Integrates TurboTax to Help US Clients File ...

1920 x 1080

List of Best Cryptocurrency Exchange Platforms (Bitcoin, Ethereum, Ripple, Litecoin, etc.): eTORO 10 eToro (Europe) Ltd., is a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC). Invest in Bitcoin on the World’s Leading Social Trading Network. 10 Best Cryptocurrency Exchanges & Platforms January 202210 Best Crypto Exchanges and Platforms of January 2022 .4 Crypto Exchanges That Keep Your Bitcoin Extra SafeTop 10+ Trusted Cryptocurrency Exchange ListGo to http://cryptotrader.tax?fpr=lje2o and create a free account to link TurboTax to your crypto exchange account to automate your crypto trading taxes. IRS. Can You Import Coinbase to TurboTax The short answer is yes. You can import your Coinbase transactions into TurboTax with the help of Cryptotrader. Cryptotrader integrates with turbotax You need to download your transaction history from the Coinbase website and use them to upload into TurboTax. There are some limitations though. Coinbase, 2021’s belle of the IPO ball, is the crypto exchange you may be most familiar with if you’re just now getting interested in crypto. That’s for good reason: Coinbase Pro, the robust . Top 10 Bitcoin and Cryptocurrency Exchanges 1. Coinbase 2. Voyager 3. BlockFi 4. Uphold 5. Kraken 6. eToro 7. Bitcoin IRA 8. Crypto.com 9. Binance 10. Hodlnaut Best Crypto Exchanges and Investing Platforms Here is our list of the 10 best cryptocurrency exchanges and investing or trading platforms. Coinbase CSV tax doesn’t work with Turbo Tax? : CoinBaseThe most used and at the same time the most reliable crypto exchange platform is Binance. Also, Binance extremely easy to use and learn. You can earn a 20% commission discount on each purchase. Binance 20% Sign Up Code: 77181558 How to Register Binance? To make an account with Binance, you should simply get enrolled on the Official Binance Website. 3 Steps to Calculate Coinbase Taxes (2022 Updated)Best Crypto Exchange : Top 5 Crypto Trading Platforms Of 2021 .Coinbase csv file not compatible on turbotax? No H.CoinTracker has partnered with Coinbase and TurboTax .Chandan Lodha. tl;dr: CoinTracker, the most trusted cryptocurrency and bitcoin tax software has partnered with Coinbase and TurboTax to make it simple to calculate and file cryptocurrency taxes. CoinTracker’s tax product is for anyone who has had a taxable crypto event and needs to file their taxes. Most cryptocurrency exchanges cannot . Best Crypto Exchanges of 2021. Best Overall: Coinbase and Coinbase Pro. Best for Beginners: Cash App. Best Decentralized Exchange: Bisq. Best for Altcoins: Binance.US. Warning. Cryptocurrency is . Most Reliable Crypto Exchange : CryptoTopDailyTop 5 Best Crypto Exchanges & CryptoCurrency Platforms [Full Reviews] eToro: Best Overall; Coinmama: Best For Beginners; BlockFi: Best Decentralized Crypto Exchange Coinbase Pro Tax Reporting Via TurboTax Crypto Exchange Tax .Best Crypto Exchanges of 2022 - InvestopediaCoinbase is the largest U.S.-based cryptocurrency exchange, trading more than 30 cryptocurrencies. Its fees, however, can be confusing and higher than some competitors. While Coinbase offers. #1 in Security Gemini Crypto - The Safest Place to Buy CryptoBest Crypto Exchanges Of January 2022 – Forbes Advisorr/coinmarketbag. Get Bag of Best Cryptocurrency CoinMarketBag is the world's most-referenced info website for cryptocurrency (bitcoin, ethereum, ripple, Binance Coin, and More Tokens) assets in the rapidly growing cryptocurrency space. Its mission is to make crypto discoverable and efficient globally by empowering retail users with unbiased . Coinbase no longer supports the direct upload of your CSV file to TurboTax, resulting in an error message for some users. Coinbase recommends using CoinTrackerto calculate your cryptocurrency gains and losses and to access your CSV file. 1 Reply Share ReportSaveFollow level 1 · 11 mo. ago· edited 19 days ago Coinbase Pro Tax Reporting Via TurboTax Crypto Exchange Tax .For the 2020 tax year, Coinbase customers can get a discount to TurboTax products using this link or take advantage of CoinTracker to determine their gains/losses. Using CoinTracker Sign up using your Coinbase account to import your transactions and calculate your crypto gains/losses. CoinTracker is free for up to 25 transactions per customer. How to load Coinbase CSV into TurboTax Premier?How to do your Coinbase Pro Taxes CryptoTrader.TaxCoinbase Pro Tax Reporting. You can generate your gains, losses, and income tax reports from your Coinbase Pro investing activity by connecting your account with CryptoTrader.Tax. Connect your account by importing your data through the method discussed below. Coinbase Pro exports a complete Transaction History file to all users. Coinbase is a dead end with Turbotax, so Turbotax needs to remove the Coinbase logo from their site instead of telling people that if they upgrade to Premier, the upload will go smoothly. But they won't do this because just advertising Coinbase compatibility brings in lots of money. If Turbotax and Coinbase want to partner up, great! TurboTax® Official Site - The Most Trusted Name In TaxesMost of the big cryptocurrency exchanges have good security programs. User-level protection such as two-factor authentication (2FA) is pretty standard. When you activate 2FA, you'll need to . And unfortunately, the Regular-Coinbase does NOT see Coinbase-PRO transactions for holdings. If you are a Coinbase-PRO user then thus far TurboTax cannot do this itself. - we'll need to use CoinTracker to build the excel sheet for us ; ( Below are the EXACT Headers on both downloads. Using TurboTax or CoinTracker to report on . - Coinbase Help